By adopting an approach of researching the opportunity and getting the administration right from the start the chance of success is increased, and that is important, as more new start up businesses go out of business leaving the sole trader with personal debts than survive in the first 3 years.

Setting up with the Business name, Business plan and personal liability risk

The first point of how to start up business as a sole trader is you can use your own name or choose a suitable business name. All transactions would be conducted under the actual name of the sole trader or the actual name trading as the business name. The sole trader own name should be used on all business stationery, letters, invoices, receipts and cheques.

As all liabilities incurred are the personal responsibility of the sole trader and there is no distinction between business assets and personal assets. Should the business incur losses, and that is quite common in the first year, all losses remain the personal liability of the sole trader.

An important part of how to start up business to take before trading commences is to prepare a business plan. A business plan is essential for a new start up if funding is being sought but is also important since the first year trading performance can be difficult. The business plan consists of sales, purchases, investment in assets and a financial profit statement plus cash flow forecast.

The major benefit initially to be obtained from the business plan for a new start up is the research the sole trader conducts into such areas as competition, market research, suppliers, costs and funding requirements. A business plan is essential to raising new start up finance.

HMRC registration, local authority licenses, retail change of use.

When trading starts, which would be the date of the first sale or purchase, all new start up sole traders have a responsibility to register as self employed with HMRC. Self employment business registration is required within 3 months of trading commencing or the sole trader may be fined £100 for failing to register on time. Following business registration HMRC will send an annual self employed tax return which has to be completed each financial year. It is usually advisable to adopt the 5 April as the year end date and so the first year would be less than 12 months trading.

The self employed registration form can be obtained by telephoning HMRC or visiting and downloading the new business registration form direct from the HMRC website.

There is no requirement to register the business or business name with Companies House which is solely for limited companies.

Depending upon the type of trade there may be a requirement to for business registration with the local authority where either an application for change of use of the premises might be required for a retail business and/or a local authority license required for the proposed trade such as a taxi driver license, child minder, restaurant or pet shop license. Sole traders need to contact the local authority to determine if a license is required for the new business.

Insurance and public liability

When considering how to start up business a sole trader consideration should be given to insurance requirements. Employers liability insurance will be required if employees are employed, insurance specific to the trade may be advisable to offer protection from claims, public liability insurance may be required and is often essential in retail trades particularly if that trade also requires a local authority license.

Payroll and Employees

The business set up status of a sole trader is not affected if employees are engaged as the sole trader is still self employed. If employees are engaged then the sole trader needs to register with HMRC as an employer and operate a PAYE scheme which involves calculating and deducting income tax and national insurance from employees gross pay, incurring the employers national insurance contribution, issuing payslips and keeping records of all employees and deductions. Income tax, employees and employers national insurance can be paid to HMRC quarterly if under £1500 per quarter or monthly if exceeding this level.

Networking with business groups

There are numerous groups a sole trader may consider joining for more information on how to start up business. The government organisation Business Link offer free advice on many issues and may have new business grants available for new start ups. Business Link also has contacts with local enterprise agencies who offer support. The Federation of Small Business charges an annual subscription, hold regular local meetings and provide a range of discounted services to small businesses.

Terry Cartwright qualified as a Chartered Management Accountant and Chartered Company Secretary in 1971. A successful business career followed as Head of Finance for major companies in the UK and several consultancy appointments. In 2006 he created DIY Accounting producing Accounting Software for self employed and small companies that use simple accounts spreadsheets to automate tax returns.

Terry Cartwright qualified as a Chartered Management Accountant and Chartered Company Secretary in 1971. A successful business career followed as Head of Finance for major companies in the UK and several consultancy appointments. In 2006 he created DIY Accounting producing Accounting Software for self employed and small companies that use simple accounts spreadsheets to automate tax returns.

Category: Starting Up

10 Tips to a Well-Funded Business

Article Contributed by Stan Spector

This may absolutely, positively be the best time to start a well-funded business if you can take advantage of these 10 factors.

1. Equipment

In many business sectors, large numbers of business are going out of business, declaring bankruptcy or downsizing. Much of the equipment from these businesses is available for pennies on the dollar if you look to purchase used equipment.

2. Customers

Many businesses are going out of business and their customer will need a new supplier. These customers are up for grabs if you can find them quickly. Hiring a sales representative from one of those companies that are closing can help you find their clients and get them to your business.

3. No Financing

Most of the companies in financial distress may rely on short-term borrowing to stock their business for the peak season, such as Christmas sales. Many will not get the credit they did in past years. So a well-funded, new business with a business model that doesn’t require borrowing every year will get a boost in these tough times.

4. Rent

Many commercial landlords are having problems keeping their property filled. You can negotiate better rents now than you have been able in many years and you can lock up long-term leases that are less expensive than your competitions. This will reduce your fixed expenses. Negotiate, negotiate, negotiate.

5. Staffing

Existing competitors have too many employees for the reduced business they have now. It is hard for them to cut loyal staff and they keep the staff on long after they can financially justify their pay. You are starting your company so are probably understaffed for the work you have. Keep it understaffed until the business grows.

6. Employees

It is hard for an existing company to reduce pay to workers that they have employ for many years. You can hire new employees that have been laid off from your competition for many months that are now desperate for a job at less than they were making before.

7. Credit

Clients now expect to be scrutinized and expect to provide a lot of private information, and possibly personal guarantees, to get new credit from suppliers. Every businessperson knows the “no doc(ument)” credit is done. Your existing competitors can’t recheck their customers credit or tighten their terms without upsetting the client. You can do this as a new supplier and possibly charge a higher price (or offer less of a discount) for clients who are desperate for credit.

8. Sector

Focus Most business have sectors of customers that are still doing fine while other customer sectors are failing. You can focus on the good sector with your products or services and avoid the deadbeat sectors that will stick you with bad debt.

9. Low

Overhead Low pricing will dominate the customer’s decisions when they consider buying from you. If you can cut the overhead by the preceding ideas, you can offer lower pricing under similar terms as your competitors and get the sales.

10. Attitude

Negative employee attitudes go hand-in-hand with struggling companies. The customers sense this and look for suppliers that have good attitudes and more pleasant customer service representatives. Even if you hire ex-employees of these failing companies, their attitude can change overnight if they are now working for a well-funded company.

Stan Spector is the author of “Baby Boomers’ Official Guide to Retirement Income – Over 100 Part-time or Seasonal Businesses for the New Retiree”. The book’s website can be found at StanSpector.com.

Stan Spector is the author of “Baby Boomers’ Official Guide to Retirement Income – Over 100 Part-time or Seasonal Businesses for the New Retiree”. The book’s website can be found at StanSpector.com.

Article Contributed by Stephanie Fish

Business burnout can be suffered by any business owner, whether you own and manage an online business or brick-and-morter business. Most people would agree that business burnout can occur for many different reasons but the most common reasons are (1) When a person tries to do every task on their own or (2) They don’t know their limitations and try to do everything for everyone, and actually end up neglecting themselves.

Here are 3 common ways to get control over your “business burnout”:

1) Chart- (also known as “plan”) Make a list of every task that needs to be accomplished, whether its personal, household or business related. Once you have everything written down assign a day of the week that you can solely focus on that specific task. Remember, every task should help you reach your goal. Charting your tasks and goals are very important for any size business. Here’s a little exercise that can help you chart your way to success. Get a large piece of paper and draw a bulls-eye with about 5 rings. The middle ring is your ultimate goal, from there each ring would be a step towards your goal. The most outer ring would be where you are today. Beside each task you should give yourself a date that represents the date you would like to begin and end each goal. Making sure you are giving yourself ample time to get a task completed makes you more focused and relaxed, there’s nothing worse than getting yourself upset over a task that wasn’t completed in an unrealistic time frame to begin with. Charting takes a little effort and some getting used to, but the pay off in the end will be worth it. If you are completely unable to focus on charting by yourself, then utilizing the assistance of a virtual assistant or business coach will be to your best advantage.

2) Outsource- Outsourcing isn’t just for the “big businesses” anymore! Every business can benefit from outsourcing, if its done correctly. If you look at your competition or perhaps a company that you admire, you’ll see that they have a team in place, with most projects and tasks being outsourced to another company. The owner does not do every task himself, infact his business is so large in part by having a team of specialists in place so that he/she can now focus on other aspects of the business. Outsourcing does not have to cost you a small fortune, if done correctly in the beginning. That’s why its so important to have your chart inf ront of you at all times.

3) (Be) Purposeful- Did you know purposeful means “compulsive, determined, driven”? To be successful in business every decision you make should be made on purpose and with a purpose. I find it very intreging how some people just jump into their businesses without a purpose and when they don’t see the increase in sales right away they give up. They might have a goal in mind, say for instance “I want to make $1,000 per week in sales” this is a statement, not a goal. What is it that you really want out of owning and running your own business? It can be as simple as you not wanting to work for someone else. Being a purposeful business owner takes time, a lot of thought and an inner desire to make it to the next level and stick with your business. Being purposeful in charting your business must include having a team in place. You can’t do it all yourself.

COPs isn’t just for law anymore, it’s what helps your business succeed in this world and help you fulfill your business dreams. Remember the next time you feel like throwing in the towel, hanging up a “closed” sign and shutting your business doors, that COPs is right here waiting on you.

About the Author

Stephanie Fish, owner of Buckeye V.A. offers virtual assistance in marketing, research, and consulting to business owners who are ready to take that next step in business. To learn more about outsourcing and building your business team, be sure to sign-up for our newsletter at www.buckeyeva.com

Private Limited Company Advantages

When considering the advantages of a private limited company registration against retaining self employed status the decision taken by a sole trader is often entirely focused upon the tax advantages. There are other private limited company advantages and also disadvantages particularly in regard to limited company accounts and administration compared to producing a simple set of sole trader basic accounts.

A private limited company advantages include:

1. Limitation of Liability

There is no distinction between business money and personal money for anyone self employed as all business debts are the personal responsibility of the sole trader. The private limited company advantages are that the company is a separate corporate body and liability for payment of debts stops with the pvt ltd company, the owners, shareholders are not personally liable. The directors are only liable if they continue to trade and incur liabilities after it becomes apparent the ltd company is insolvent.

2. Lower Taxes

Lower corporation tax offered a private limited company advantages over self employment in recent years. The £10,000 tax free limit was cancelled several years ago. Corporation tax rates have increased from 20 per cent to 22 per cent for small ltd companies over the last three years compared with the basic rate tax for a sole trader which has reduced from 22 per cent to 20 per cent Incorporation does still offer tax saving advantages dependent upon the net profit before tax.

The private limited company advantages come from the flexibility of being able to determine the proportions of salary and dividends taken compared with a sole trader whose basic accounts are subject to tax at fixed tax rates and thresholds.

A sole trader receives a £6,035 personal allowance and pays basic rate tax of 20 per cent on the next £34,800 of earnings up to the higher threshold limit and 40 per cent tax thereafter. Class 4 national insurance is 8 per cent of earnings up to the upper primary threshold and 1 per cent thereafter.

Dividends are taxed at 10 per cent on total income up to the higher threshold and 32.5 per cent above. The dividend is a distribution of company profit after corporation tax has been deducted and so the shareholder also receives a dividend tax credit from the pvt ltd company of 10 per cent.

There are significant private limited company advantages regarding tax liability compared to a sole trader where net income is below the upper earnings threshold.

For example assuming the limited company net profit before salary is £35,000. A sole trader would pay income tax of £5,793 plus national insurance of £2,317.20, a total of £8,107.20.

If a salary of £6.035 is taken and the rest is taken in dividends a private limited company would pay £6,372.30 corporation tax, after deducting the salary from net taxable profit and the sole trader now the shareholder would pay no income tax.

The advantages increase where net taxable profit is above the self employment upper earnings limit as money can be left in the business and therefore only subject to the 22 per cent corporation tax rate thereby avoiding the sole trader 40 per cent tax rate. Another possibility is to distribute the shares among family members to reduce the risk of 40 per cent tax.

3. Limited Company accounts and Sole Trader basic accounts

Sole trader basic accounts can be quite simple as a formal accounting system is not required and can be reduced to simple lists of income and expenditure supported by documentary evidence of sales and purchase invoices, effectively single entry bookkeeping. Producing a balance sheet is optional. Due to the simplicity then an accountant may not be required saving a significant cost.

Ltd company accounts have to use double entry bookkeeping to produce the year end accounts including a balance sheet with statutory notes and statements. Unless accounting software is employed to produce the company accounts in this format then accounting knowledge is required and an accountants fee may well be in the region of £500 to £1,000. An accountant is not essential for a small pvt ltd company but is the normal approach and offsets some of the tax advantages.

4. Additional financial considerations

Because a director is also officially an employee of the pvt ltd company this gives rise to a number of considerations in determining the extent of a private limited company advantages.

Pension contributions of a sole trader are personal and while may be deducted from the personal income liability do not form part of the basic accounts. The pension costs including any company contribution to a pension scheme by a private limited company is a deductible business expense as an employee cost.

Using a car for business purposes may have an impact. The sole trader basic accounts would include the business proportion of the vehicle running costs or the mileage allowance. If that vehicle is used by a director then that director is receiving a taxable benefit potentially resulting in a higher tax burden depending upon the type of vehicle as taxable benefits vary. An alternative may be to leave the company vehicle privately owned and the director claim mileage allowances rather than vehicle running costs.

Potentially small issues but there differences in the accounting treatment of deductible expenses such as charitable donations, entertaining expenses and use of home as office. A private limited company advantages consist of being able to claim such expenses as valid business expenses which would not be claimable in the sole trader basic accounts as treated as personal not business.

If the director and main shareholder have other associated companies then the corporation basic tax rate could be affected.

5. Administration, management and business standing

A sole trader basically pleases themselves with regard to the administration and management of the business. A company director is responsible for adhering to company administration according to statutory regulations in regard to both the limited company accounts, statutory books and management as stated in the articles of association. The duties of a director are more formal than a sole trader.

Forming a private limited company is an indication that a business is both serious, has a long term objective and is correctly managed. This psychological perception can increase the business standing of a business. In addition funding requirements are more likely to be met as the lender to a sole trader has to consider the absence of a balance sheet statement in the basic accounts and the financial influences personally affecting the sole trader. A private limited company advantages concern the published financial statements, protection of the financial position from personal influences and the option of increasing security by virtue of asking directors to provide additional personal guarantees.

A private limited company advantages over self employment also extends to long term finance. Companies tend to retain more funds within the business to meet future financial commitments which aids year on year growth, a more sustainable business and medium term profits growth over a sole trader.

Terry Cartwright qualified as a Chartered Management Accountant and Chartered Company Secretary in 1971. A successful business career followed as Head of Finance for major companies in the UK and several consultancy appointments. In 2006 he created DIY Accounting producing Accounting Software for self employed and small companies that use simple accounts spreadsheets to automate tax returns.

Terry Cartwright qualified as a Chartered Management Accountant and Chartered Company Secretary in 1971. A successful business career followed as Head of Finance for major companies in the UK and several consultancy appointments. In 2006 he created DIY Accounting producing Accounting Software for self employed and small companies that use simple accounts spreadsheets to automate tax returns.

Article contributed by Michelle Ulrich

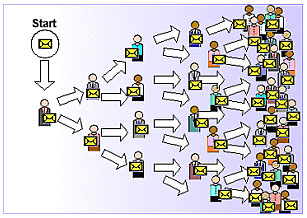

1.Social networks – how to work it

a.http://www.craigslist.com

b.http://www.fastpitchnetworking.com

c.http://www.ryze.com

d.Ning.com is a create-your-own social network site

2.Free Classified Ads

a.Backpage

b.Craigslist

c.MySpace – need to be a member with a profile, I believe

3.Teleclasses/Podcasts

a.These can be pre-recorded if you don’t want to interact with others

b.Teleclasses are great for getting the word out about your products/services; guest speakers can promote you to their list and increase your list on a monthly basis

c.Use www.fullcalendar.com to promote teleclasses and events

4.Joint Ventures – co-creation of…

a.New products

b.New teleclasses

c.New workshops

d.New podcasts

e.New ebooks

f.Limitless ideas…

5.Strategic Alliances

a.Promote one another via banner ad exchanges

b.Promote one another via ezine or newsletter mentions

6.Article submissions

a.Write an article – submit online

b.Repurpose into an ezine article or ezine series if article is long

c.Repurpose into a podcast

d.Repurpose into an ebook with additional resources

e.Repurpose into a speech/presentation for live events

7.Ezine submissions

a.Write an ezine – submit online to ezine banks

b.Repurpose into an article

c.Repurpose into a podcast

d.Repurpose into an ebook with additional resources

e.Repurpose into a speech/presentation for live events

8.Ezine with tips, resources, trends

a.Submit to ezine banks for additional subscribers

9.Blog

a.Blog or have someone else blog for you no less than 3x/wk

b.Pick a theme for each month to make it easy

c.Base the theme on your teleclasses and ezine, etc. to make all items/tasks easier to complete

10.Affiliate accounts

a.Amazon – book store, software store, web store, etc.

b.Commission Junction

c.Create your own affiliate account – essentially provides a means for others interested in your product a way for them to make a small percentage while you gain a virtual sales force

11.Blogtalk Radio – 15 mins – longer monologues or full blown radio show; record to podcast

a.Repurpose into an article

b.Repurpose into an ezine piece

c.Repurpose into a podcast

d.Repurpose into an ebook with additional resources

e.Repurpose into a speech/presentation for live events

12.Get involved; share your passion

a.Share your passion with others

i.Online

1.Social networks

2.Forums

3.Message boards

ii.In person

1.Networking

2.Volunteer opportunities in community

3.Church

4.Youth groups

5.Etc.

iii.Don’t forget to share your projects and/or websites with others

About the Author

Michelle Ulrich is the Chief Villager and founder of The Virtual Nation™, an educational destination for Virtual Professionals around the globe. Michelle is an avid believer in giving back to her industry and she does this by offering coaching, teleclasses, resources, and tools, in addition to providing a community of learning, a nation of culture, and a virtual village for her members.

She maintains her private practice where she specializes in working with authors, coaches and speakers who struggle to keep up with e-commerce and new technologies. Clients can check out her services at www.virtualbusinessmarketing.com, while Virtual Assistants can find her over at www.thevirtualnation.com. She can be reached by telephone at (916) 536-9799 in the Pacific time zone.