Merchant cash advance transactions are big business. In the past few years, the industry has grown from a few providers to what some predict will be an almost 10 billion dollar industry. Search engine results for “merchant cash advance” produce literally thousands of provider results. How do you wade through all of these providers to find the right one for your business? How do you get the best deal? Here’s a quick guide to a successful merchant cash advance transaction.

Only “merchants” can apply. A merchant is someone that owns and operates a business that performs credit card processing functions as a way to accept customer payments. Providers have different requirements regarding the length of time you need to be in business- many also require a certain sales volume for approval. Generally, you’ll need to have at least a few thousand dollars in credit card sales to qualify for a cash advance transaction.

You have to qualify. Cash advances have become a popular method of financing because the approval process is fast and easy. But be careful- just because you’re “approved” doesn’t mean you’ll be able to repay the advance according to the agreement. Many unscrupulous providers have been known to approve businesses they know won’t be able make repayments as scheduled in order to collect the fees and penalties associated with defaulting.

Service agreements set the terms. Once you’re approved for a business cash advance, the provider will send you a service agreement with all of the important information- your advance amount, the “safe” retrieval rate (based on your daily credit card sales volume), and advance fees should all be included in this agreement. Since a merchant advance isn’t a loan, it isn’t subject to lending or usury laws- providers can basically charge whatever they want for services, up to 50% or more of the advance amount in some cases. Be extremely wary of agreements with fees that kick in if sales volume drops below a certain amount (called daily minimum fees) or “balloon” repayment clauses that require payment in full if certain conditions are or are not met.

Repayment is taken from daily sales revenue. You begin repayment the day you receive your advance check, much like a traditional loan. Before you take out an advance, you need to make sure that your current sales volume is able to support the repayment structure specified in the agreement.

What happens next? If you repay your advance according to the agreement, everything is fine. Repayment is usually quick- you should have the advance balance paid off within several months of initiating the transaction. The service agreement governs potential defaults- most agreements contain some kind of a “balloon” repayment clause (see above) or give the provider the authority to place a lien on business equipment or property if you can’t pay back the advance. Providers have also been known withdraw money straight from a business checking account. Before you sign the service agreement, you need to make sure that you know exactly what will happen if you can’t repay the advance according to the terms.

Category: How-To Guides

Here’s a tough question: What’s the one thing nearly all business owners consistently overpay for?

The answer is pretty surprising: Postage costs. Stamps, shipping charges, even the time it takes to go to the post office can all add up, costing thousands of dollars or more each year, depending on the volume of mail you ship. Most business owners don’t know exactly how much it costs to mail a particular parcel- so they end up “over stamping” and overpaying- often by quite a bit. Postal stores and shipping providers have overhead costs to meet, too- you pay for these when you’re charged to ship an item.

You can avoid overpayment- and create big savings- by using a postage meter. A postage machine, or digital mailing system, can calculate postage costs precisely, so you’ll never overpay, and can be used in-office, saving you trips to have packages shipped from other providers. Here’s a quick guide to using a postage meter:

How meters work

Postage meters are leased, and work similarly to a parking meter. You “fill up” by making a payment, and postage charges are drawn against your balance. Most meters allow you to “refill” when necessary, and some calculate monthly charges and send a bill- similar to paying for electricity costs. In addition to paying the postage charges, you’ll also need to lease the equipment. You can choose machines with advance features (scales, document feeders) or a simple stamp machine that just prints postage stamps on your outgoing mail.

Features

Mailing machine equipment can be very simple (a stamp machine) or very complex- some machines fold, collate, stamp, and stack bulk mailings containing several different printed pages. If your business sends large bulk mailings, you could benefit from such a machine. Machines can also be fitted with equipment to ship packages- you’ll weigh the parcel and arrange for the pickup online in a few simple steps. No matter which features you need, you can take advantage of cost savings- with a postage meter, shipping costs can be calculated down to the penny for each mailing, so you’ll never overpay.

Costs and billing

Equipment leasing costs can range from less than $20 a month to hundreds for sophisticated equipment designed to handle large volume mailings. You’ll pay for the postage machine equipment (the meter) as one bill, and pay postal charges according to current rates. Some meters only allow you to “pre-pay” postage charges, while other companies allow you to “pay as you go,” where you receive a bill for both postage and meter use costs at the end of a specified period of time. Pay-as-you-go options usually carry additional charges or fees.

You’ll generally sign a lease contract that specifies your terms of use for the meter. Longer term lease contracts can be significantly less expensive- if you’re willing to commit to a longer period of time using the equipment, you’ll get a better monthly rate. You can also choose to purchase a maintenance or service contract that covers repairs or part replacements over the life of the machine.

As the saying goes, you only get one chance to make a first impression. This is especially true when it comes to web design. A recent Nielsen NetRatings survey sets the average webpage view at 60 seconds- meaning that internet users decide in less than a minute whether or not to continue browsing your site! This makes a well designed website is an absolute necessity- you need to reel customers in at first glance and keep them browsing with a site that’s easy to navigate and pleasing to the eye.

How do you make sure your site is what customers are looking for? Can you just buy one of those “Websites for Dummies” books and do it yourself? Probably not, if you want quality results. When it comes to web design, it’s a good idea to hire a professional- someone who can work with you, using their own experiences and skills, to craft the site you want.

Professional web design isn’t out of reach for businesses with stretched resources. Here’s a quick guide to making the most of your web design budget, so that you can get the site you want at a price you can afford.

Set up a basic contract

You don’t need to hire a designer to design a full site all at once. You can split up the design process to accommodate your resources by contracting for site architecture or homepage design only, and then moving forward when you’re able to afford additional services. Breaking the contract into phases also gives you more negotiating power- when services are finished, you can negotiate prices on the next phase of design.

Negotiate

In the initial stages of contract formation, you’re in the best position to negotiate. During your first meeting with a designer, you should discuss your goals (better ecommerce functioning, better graphics, etc.) and how you want the site to look and feel. You’ll also discuss timelines and budget, and might even work on forming an agreement draft. Try to get an idea of the total cost for the site, getting a written quote for services if possible. Consulting with at least a few different web designers will allow you to get an idea of pricing structures, and help you negotiate a better deal.

What to ask for

One of the best ways to save money on a web design contract is to ask for a project cost rather than an hourly billing structure. With hourly billing, the designer bills you for the time it takes to design the site- a factor that’s completely outside of your control. If you end up requesting changes or making modifications to design work, costs can quickly increase. By asking for a total cost, you’ll know exactly how much you’re paying.

While most designers will charge for additional services not specified in the contract, you can ask that potential additional design costs be specified in your initial agreement. That way, if you want to make changes, you’ll know exactly how much they will add to the total cost.

You can also ask to pay in installments as each stage of the project is completed. Smaller company or a freelance designers are generally more flexible when it comes to payment timelines, so you might be able to request extensions or modifications to the payment schedule even after you’ve signed the contract.

What should be in the contract?

The contract should contain a description of services, a timeline for completion, a breakdown of total costs, and a description of ownership rights. It should also address web hosting issues. It’s also helpful to specify the procedures for approval of completed work, or notification when changes need to be made. The contract should not contain an outline of design specifications or web programming elements. Usually, designers retain the copyrights to a site they have created, unless they are “working for hire.” It’s important to make sure that you can make changes to the site if you need to- even if you hire a new design company.

Merrin Muxlow is a writer, yoga instructor, and law student based in San Diego, California. She writes extensively for Resource Nation, a company that provides resources for business owners, and is a frequent contributor to several sites and programs that offer tools for entrepreneurs, including Dell and BizEquity.

Merrin Muxlow is a writer, yoga instructor, and law student based in San Diego, California. She writes extensively for Resource Nation, a company that provides resources for business owners, and is a frequent contributor to several sites and programs that offer tools for entrepreneurs, including Dell and BizEquity.

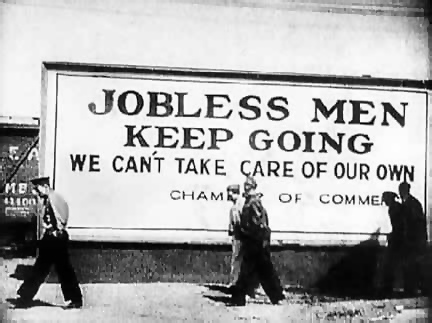

Every time I turn on the news I feel like screaming. I am sick and tired of hearing about how bad the economy is. Unemployment is up and is only going to get worse. Banks are in trouble and going under. Real estate is a mess and there is no end in sight. Major corporations are going bankrupt – heck, even the big three automakers may go under.

I hear about how this is the next great depression. I hear about the collapse of the dollar, the collapse of the western world, and the end of society as we know it.

It Isn’t As Bad As It Sounds

The sad part is that it isn’t all that bad. Yes the economy stinks, but this is only when compared to the amazing boom we experienced in the last decade. Companies have been able to go after the low hanging fruit-heck, there was more lying on the ground than you could pick up!

Just because the ground isn’t littered with business anymore doesn’t mean that there isn’t business out there. You just have to work for it. And the past decade of easy business means that most companies have not made the connections and built relationships. Now they pay the price.

And at the end of the day, now is the time where entrepreneurs can really shine.

No, I’m not crazy. Think about what a true entrepreneur does.

- He connects with his customer

- identifies his needs and problems

- then creates products and services to fill those needs or problems

In other words, he gets paid to solve problems

Now more than ever companies are in trouble. Your customer desperately needs you. No, he isn’t spending indiscriminately. But if you solve his problem and help him survive (or thrive) in this downturn he will be your customer for life. And you solve your “slow business” problem at the same time. Only an entrepreneur can do this, and you finally have an advantage over larger companies.

Simple, but Hard to Do

This is a simple concept that is hard to do. I’ve written several articles that are aimed at this:

- Recessionproof your sales

- How to Thrive in a Recession

- How to Thrive in a Recession – Ignore the News

- How to Thrive in a Recession – It’s All About the Customer

- How to Thrive in a Recession – Working for Someone Else

Brandt Smith is a sales, marketing, public speaking, and professional development expert. Learn about achieving wealth and life balance through entrepreneurship at Wealth and Wisdom, where he is cofounder and senior editor. Their advice on wealth building, personal development, and life balance can help take you to the next level. You can also read more of his thoughts on his blog.

Brandt Smith is a sales, marketing, public speaking, and professional development expert. Learn about achieving wealth and life balance through entrepreneurship at Wealth and Wisdom, where he is cofounder and senior editor. Their advice on wealth building, personal development, and life balance can help take you to the next level. You can also read more of his thoughts on his blog.

If you’re starting a business right now, marketing can be one of the first efforts to take a hit. After all, why should you market products aggressively to customers who aren’t ready to spend?

Cutting back on marketing efforts right now is actually a pretty risky move- studies show that companies who increased or maintained marketing budgets during lean times are rewarded with more sales as the economy begins to pick back up. According to McGraw-Hill research, companies who increased or did not change marketing budgets during the ’81-’82 recession saw significantly higher sales growth within five years- over twice as much as those companies that chose to cut back.

So how do you design and implement an online interactive marketing strategy on a shoestring budget? What can you save on when contracting for services? Here’s a quick primer on choosing an online marketing company and forming the contract you want- at a price that’s within your budget.

Evaluate your requirements.

Do you already employ online marketing strategies such as email blasts, customer follow-up emails, or search optimization strategies? If you’re already working with an online marketing firm and are unhappy with the services you’re receiving, the price you’re paying, or both, figure out exactly what you need before you switch or begin to negotiate. Do you want to build relationships, increase brand visibility among certain customer groups, or stay in touch with existing clients? Evaluate your needs before choosing- or choosing to stay with- a company: List the services you want and how much you’re willing to pay.

Re-negotiate.

If your current online marketing firm is meeting your needs, you can still negotiate on price. Most of the time, this means contracting for additional services or a longer term- a better deal in the long run if you’re working with a reputable company. You may be able to get discounted services simply by asking, especially if your contract is about to expire. Trying to re-negotiate your existing contract- if you have one- is a step you should take before looking for a new provider.

Use smart bargaining tactics.

If you’ve narrowed down the field of providers to a few worthy contenders, try to negotiate with each to get the best deal for services. Most vendors are a bit more flexible and open to bargaining near the end of the month or the end of a sales quarter. You can ask for more services, an extended agreement, a payment plan, or any other compromise that reduces your out-of-pocket-cost. Up-front payments (retainers) are usually not negotiable- most vendors will require some monetary outlay before beginning work.

Get a written estimate or service quote.

These usually serve as previews for the final contract. It should be specific, but not too specific- it can be a good idea to split projects into phases if you’re using several different strategies. You should have access to all necessary information (graphics, advertising agreements, affiliate information) in the event that you ever decide to use a different company for later efforts. Make sure that you compare several different service quotes to get an idea of the “going rate” for services- this places you in a better position to negotiate.

Make sure you can track efforts.

Make sure you know how results are tracked. Will you be able to monitor key information (web traffic, conversions, etc.) yourself? Make sure you know how results of the marketing strategy will be measured.

Online marketing is one of the most effective methods of sales generation. Make sure you shop around for a company, compare price quotes, and ask for references. A good firm won’t ever “guarantee” a certain search engine result or output, but will be able to accurately track the results of their efforts. Spending on marketing is effectively investing in future sales- make sure you invest wisely.

Merrin Muxlow is a writer, yoga instructor, and law student based in San Diego, California. She writes extensively for Resource Nation, a company that provides resources for business owners, and is a frequent contributor to several sites and programs that offer tools for entrepreneurs, including Dell and BizEquity.

Merrin Muxlow is a writer, yoga instructor, and law student based in San Diego, California. She writes extensively for Resource Nation, a company that provides resources for business owners, and is a frequent contributor to several sites and programs that offer tools for entrepreneurs, including Dell and BizEquity.